The first trade came of a Short USD/CHF:

This trade was a Spring in a relative S/R zone, Ok the price went to the first support but I managed it bad and put BE quickly. (I saw some bars showing strengh). Then after some more strengh came I didnt took the long. Have to revisit my plan on this kind of trades.

------ Trade Nº 2

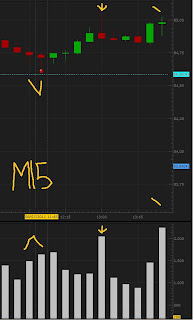

This one is funny because I readed the market well, I saw some buying going on Above a Structure point and decided to buy expecting the news of CAD and get a rally. The idea was good, but then the News came good as expected but I saw some BIG SELLING on the Futures and Spot m15.

I convinced my self to wait and see the news instead of Close the position to that vert typical move from the SM (Selling to good news), and I didnt move my SL also.

Anyway Im learning from writing this now, so I really won something more interesting than the pips today :)